After a brutally long offseason, we are now back at everyone’s favourite time of year. That’s right, it’s budget season! We’ll cover that in (a lot) more detail below in the Notable Debates section, but for now let’s get on with the standard recap of Tuesday, November 28’s standard council session.

This meeting started off with public participation, and a few prominent folks from the Eastern Shore made the two-hour trek downtown to City Hall to explain the city’s legitimacy crisis in rural areas. Among them were Richard Bell (not speaking in his official capacity as editor of the Eastern Shore Cooperator) and Greg Cross, director of the Sheet Harbour Chamber of Commerce. The four speakers all highlighted that they pay taxes, but receive almost no municipal services in return for those tax payments. Garbage collection and doctor recruitment were both cited as examples of work local volunteers are expected to do that other cities, towns, villages and hamlets in Nova Scotia send paid employees to do.

Not to get too big-brain-political-science-y about it, but our democracy, municipal or otherwise, only works if we all buy into it. We all need to pay for it, and in exchange we all benefit from the better outcomes for our collective endeavour. But in the HRM right now, the further away you get from the Circumferential Highway, the less you get from the HRM’s government.

It’s easy to dismiss the complaints of rural residents, because it is our choice to live as far away from the city as we do, like a five-minute drive from Cole Harbour, and it is also unrealistic for us to expect frequent bus service to our low-density far-flung homes. But it should not be unrealistic to expect a reliable rural transit option, like we have in publicly subsidized services like Musgo Rider. But as our taxes go up, Musgo Rider becomes more reliant on volunteer hours, or community donations. It’s the unofficial area rate that is added onto our municipal taxes. This is, of course, on top of the actual area rates we need to pay to get services included for other areas of the HRM in the general tax rate. Suburban areas, in spite of paying the same taxes as rural residents, don’t usually have to pay area rates for improvements to their communities. Even though suburban communities are just as much, if not more of a drain on municipal resources than rural areas.

And this is where it gets tricky for municipal councillors. Because it doesn’t really matter what the truth is. Suburban voters have the power of electoral density. Rural voters do not. Suburban voters can not be ignored. Rural voters can.

In the early 1990s, the province’s forced marriage of amalgamation decreed that urban Halifax, suburban Bedford and rural Halifax County were all the same city. At some point since then, it’s started to feel that those of us in rural areas have paid more in taxes for fewer services, while other parts of the regional municipality get love and attention. It starts to feel like your money is funneling into the city while your community struggles. It starts to feel like paying taxes is a scam. And this, if left unchecked, will eventually lead to a Free Sheet Harbour movement. Although in reality, Hubbards is more likely to lead the de-amalgamation rebellion, as Chester and the HRM and the province refuse to work together and make it safe for children to walk around.

There are a couple of ways to deal with this growing taxation resentment, which we’ll get to when we get to councillor Tim Outhit’s motion that is going to blow up the municipal budget process for the better.

Speaking of legitimate governing, there were 20 tents in Grand Parade on Tuesday. This is a decrease of nine tents since Oct 19, 2023. There are two major factors that are likely responsible for this decrease: The first is the surprise wind storm on Monday night. The second is that even though council heard, at that Oct. 19 meeting, that it was important that unhoused people feel welcome, the city has decided that’s only important in places that aren’t their front yard.

Things that passed

Council changed area rates on Lake Eagle Drive and Lake Mist Drive to be on a per-lot basis, not a per-foot basis. As mentioned above, an area rate is an additional tax placed on homeowners in certain spread-out areas, to help pay for municipal services that denser communities get from their base tax rate. The report reads: “The rationale is that HRM funds tied up in the costs of these projects is not available for other purposes or to earn interest for the benefit of HRM taxpayers in general, so including a bridge financing fee in relevant local improvement charges would remedy this.” While this is true, it’s also true that folks in Sheet Harbour are less likely to consider themselves an “HRM taxpayer in general” for a capital improvement in the city centre, two hours away.

Council raised some permit parking fees around SMU, while lowering the ones around Dal and the hospitals, to level out permit parking in this area of the south end at $50/month. The city also pitched raising the price of permit parking downtown by $15 and expects to make $15,000 from the move. This was approved.

The city will likely get rid of Almon Alley, eventually, as this process was started by consent on the consent agenda.

(As a reminder since it’s been a while, the consent agenda is a list of stuff all councillors agree on, and vote to pass in a group at the start of the meeting. Before this approval happens, councillors have a chance to—and often do—pull things off the consent list to have a debate.)

Council adopted guidelines for how the lens of diversity and inclusion can or should be applied to future staff reports. Here’s to hoping they start in transportation.

Young Street Lands (a huge chunk of land that includes the Robie Street stretch where Shoppers, Rona, Esso and the double Tim Hortons drive through currently exist) is getting the growth node planning treatment.

The planning for a Westwood Hills Egress will move forward.

Halifax is going to figure out if and/or how to build up around the grain elevator at the end of Bland and Atlantic Streets. Councillor Russell voted against this for reasons that couldn’t be fully explained out-of-camera.

Lake Banook Canoe Club is getting renovations done, but it’s a heritage property and they are making “major” changes, so this needed council’s approval.

People in Castle Hill are having too much fun playing pickleball, so councillor Kathryn Morse is going to see if she can’t figure out how to get the city to be a killjoy. This will get a report.

A the Committee of the Whole met to get a report about the Tantallon wildfires. This report is kind of underwhelming, and is one third of the expected after action reports. The feds and city are also expected to give council a report in the near future. For an expert’s analysis on this report, HRM Fire News did a good summary here.

Budget Committee

Before we start talking about the budget and where the city might go with the budget this year, it’s important that we’re all on the same page about where the city is, financially speaking.

Jerry Blackwood, the city’s chief financial officer, oversees the municipal budget. It guides city spending, which will be about $1 billion next fiscal year when all’s said and done. The exact number will change over the next few months as councillors debate what to fund and what to cut. Then once that spending is planned, the city has to make sure there’s enough money coming in to pay for it.

Since the city can’t take on debt (at least not easily, which is a whole other story), that spending needs to be covered by revenue. Things like parking fees or property taxes. Since the city’s revenue is limited (we demand free weekend parking) or works against the city’s goals (increasing transit fares decreases ridership and makes congestion worse), councillors are left with raising taxes or cutting services. Why is insert city service doing so poorly? Because we have free parking on Sundays and low taxes.

In our current fiscal year—April 1, 2023 through March 31, 2024—the city is projected to run a deficit of $8 million. At this early point in planning for next year, 2024/25, the draft budget is expected to be out $108 million. To reduce that shortfall, city accountants are recommending not funding some capital projects, and not funding some strategic reserve funds, like HalifACT. They were also recommending a tax increase of 9.7%. That’s a big number, reflecting big money problems.

In a lot of ways the city is not financially sustainable. (The following summary is going to abridge multiple, complex, generations-long problems into about five sentences. So please read with that piece of context in mind.) The city is not financially sustainable because our development choices and transportation choices have been objectively the wrong ones for about 70 years, give or take a few. This has been exacerbated by about 70 years of politicians not knowing, not caring or not wanting to change things for various reasons. And, on top of that, those same politicians have been successfully able to build out and develop unsustainably on low taxes because the real estate market was hot. Instead of using that hot real estate money on sustainable city building, politicians of decades past—shout out to councillors Outhit and David Hendsbee!—approved more unsustainable growth.

The city mainly gets its revenue from taxing property. They tax people for owning it (property tax), and tax people for trading it (deed transfer tax). The hot real estate market made for surprise deed transfer windfalls. Previous councils, and in previous years this council, used this money to keep taxes artificially low, instead of keeping taxes high and building out some of the infrastructure we needed then, and still need now, to close the massive sustainability gap in the HRM. Now the real estate market is cooling, the deed transfer cash tap is turned off and all we’ve got is the sustainability gap. This is why councillor Sam Austin asked Blackwood if he was wearing an “I told you so” shirt under his suit. Blackwood said no, but he has been warning council of this eventuality since he took over for his predecessor Jane Fraser. She too, would have been justified in wearing that shirt on Tuesday.

And now everyone is broke as we are being gouged by wildly underregulated multinational companies as the Bank of Canada is raising interest rates to increase the amount of people losing their jobs.

It is in this context that councillor Outhit blew up the budget process.

It happened as councillors were debating keeping the property tax rate low again, rather than going with the suggested 9.7% increase. Times are hard due to massive failures of regulation at the provincial and federal levels, so city councillors were considering exacerbating that failure of governance at the municipal level.

Councillors are in a catch-22. They can keep tax bills low, but in doing so underfund much-needed municipal services. Or they can fund municipal services and raise taxes. Lower bills and better services are both things that we want. Higher taxes and fewer services are both things we don’t want.

In the old way of doing things, business units would keep the status quo, and come to council for changes. Take, for example, the meeting where Halifax abandoned its promise of achieving #VisionZero by switching to per capita reporting. In that meeting, Lucas Pitts, director of traffic management, told the committee “as apolitically as possible” that they should consider investing in road safety at intersections this year, because that’s where road safety money would actually make a difference. In the old budget process, money wasted on safer speed humps was baked in. And Pitts was going to have to make a pitch for intersection improvements at budget time.

Now, with Outhit’s motion, the budget *should* be priority first, status quo second. Meaning for this specific case of street safety, come budget time, Pitts’ pitch for intersections should be baked-in spending. Then, if council wanted, they could spend more on speed humps, if they wanted to raise taxes. (The motion also took 9.7% off the table, at least for now.)

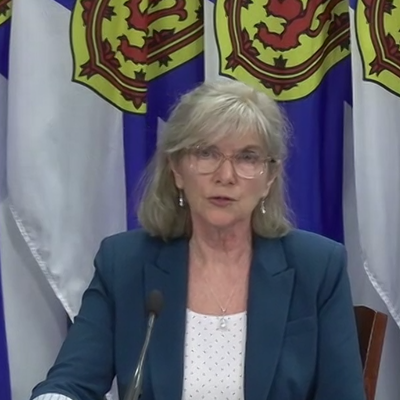

And it’s, way, way, way too early to talk about policy based budget processess that could fundamentally improve municipal budgets as early as next year. But chief administrative officer Cathie O’Toole told council that Halifax Water does that, so maybe the HRM should too. It’s honestly hard to articulate how good that possible future could be for the HRM. And all of the HRM, from Hubbards to Sheet Harbour.

And that’s because council also passed some amended strategic priorities for this year’s budget. These amendments are largely a step in the right direction, and the city is starting to correct the mistakes of development past. For example, for the first time (in five years) the city is recognizing that economic growth requires building places people want to live, instead of building things like present-day Cole Harbour.