For example, using 2007 numbers, under "tax reform" homeowners in Halifax's south end will see an average reduction of $2,065, a 61 percent decrease, in their property tax bills, with a resulting average bill of $1,317. Homeowners in Eastern Passage, however, will see an average *increase* in their property tax bills of $347, a 35 percent increase, resulting in an average tax bill of $1,334.

The average tax bill in Eastern Passage will be $17 more than the average tax bill in the south end, even though the average tax assessment in the south end, $432,700, is more than three times higher than the average tax assessment of $129,326 in Eastern Passage.

The document is titled "Preliminary Analysis on Best Possible Tax System." You can see it here---that is the original document, as written, but I've added the "change in taxes" column.

While the document suggests that taxes are going to be slashed on the peninsula and raised in the suburbs, it misses the more profound effect of "tax reform," which is that no matter where they're located, in general taxes on properties worth less than about $180,000 will go up, while taxes on pricier homes will go down.

Some might look at the chart and say, "Good: the peninsula is being charged less, and the suburbs more, as it should be." But that's not the case. It's more true to say that wealthy people on the peninsula will pay less, while working class homeowners on the peninsula will pay more.

Consider the Bill Gates example: Bill Gates walks into a bar, orders a drink and sits with the regulars. Someone decides to cut his taxes by 80 percent, but raises all the regulars' taxes by 20 percent. If you package the deal like the "tax reform" chart does, everyone in the bar just got a tax reduction!

This document, which was also handed out at the workshop, starts to get at the effect "tax reform" will have on differently valued properties. It shows that, on average, properties valued at less than $100,000 will see the municipal portion of their property taxes increase, on average, from $490 to $1,170---a 140 percent increase. Meanwhile, properties valued between $500,000 and $1 million will see the municipal portion of their property taxes reduced, on average, from $3,270 to $1,280--- a 61 percent decrease.

That document obscures what happens in mid-valued properties, however-- it shows merely that properties valued between $150,000 and $200,000 will, on average, see the municipal portion of their property taxes reduced by $60. But "on average" is the operative term--- it depends on where in HRM the property sits, but, as I mentioned above, those properties valued at less than about $180,000 will see their taxes increased, while those valued at over $180,000 will see their taxes decreased.

But the proposal is much more complicated than either I or the documents suggest. There are different calculations for apartments and condos, for properties within one kilometre walking distance to a bus stop, within 7.5 kilometres to a "local recreation centre" (but not a "regional recreation centre") and so forth. Each one of those calculations involved a judgement call by the Tax Reform Committee--- a judgement that any other collection of people would likely make differently.

It's not that the people on the Tax Reform Committee are stupid or used the wrong numbers, but rather that the creating the formula is not an exact science. The Tax Reform Committee evidently thought a one kilometre walk--- not 1,002 metres, not 998 metres---is exactly the outside limit of walkability to a bus stop. Someone else might say it's more than that, or less, or it depends on if you have to walk uphill or not. The Tax Reform Committee thought driving 7.5 kilometres to the gym is exactly the outside limit of accessibility. Someone else might consider the number of traffic lights, or the potholes en route. The Tax Reform Committee gave a 50 percent "density bonus" to apartments. Someone else might look at the situation and decide the bonus should be 47.2 percent, or 98 percent.

In the end, the various judgement calls add up to a truly arbitrary formula--- an uncomfortable truth for a proposal that is sold as a rational division of service fees.

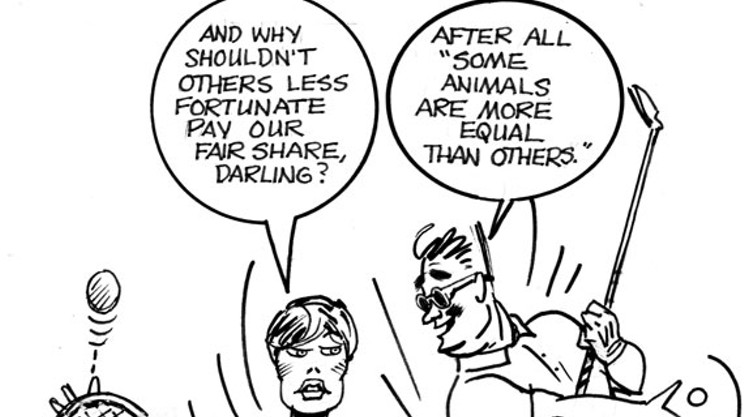

Class war

But let's not lose sight of the overall aim of "tax reform"--- which is to shift the burden of taxation off high-valued properties and onto lower-valued properties. It' is, quite simply, class warfare by the rich.

Many people would disagree with that statement. I recently received a very thoughtful email from a proponent of "tax reform," who points out that she lives on the peninsula and lives an eco-friendly lifestyle. "I'm really, really, really tired of subsidizing the people who live in huge homes in the suburbs and drive two cars (more when their kids grow up)," she writes. "Most of these people make more money than I do. They are a drain on our collective resources."

Certainly, "tax reform" has been sold, in part, as a way to encourage density. More crudely, but not so much in public forums, it's understood in some circles to be a way to shift the tax burden onto the suburbs, where "they're not paying their fair share."

People in the suburbs would disagree with that view, of course. But whether that sentiment is valid or not is besides the point, because in reality, under the "tax reform" proposal, the tax shift is greater within the suburbs than is the shift between urban and suburban areas.

Let me use a specific example. The house below is at 64 Oceansea Drive in Glen Margaret, on the road to Peggys Cove.

Main entry to this 5600 Sq. ft. luxury home is special in respect to both its design and its perfectly positioned oceanfront setting is through stone pillars and via a level concrete private drive. The home exudes impeccable design, fine craftsmanship and detailing plus unique and exquisite appointments such as cabinetry, moldings/trim, trayed ceilings and more. Features include as high as 10, 12, 14, and 18 ft. ceilings and a “barrel vault” dining room ceiling with hand painted exquisite motif, stunning island kitchen with abundant space, granite finishes and sunroom. Outstanding main floor family room, master suite like no other with double fireplace and den/office, separate children’s quarters, exquisite bar and games room leading to outdoor entertainment areas. Like the home, the grounds are hugged with unique quality features along 366 feet of prime protected shoreline, wharf and floating dock. This home and its surrounding is an undisputed leader in luxury!You can buy it, if you have $1,975,000 lying around.

Assuming that the property sells at the listed price, under the existing tax system the happy new owners will pay $15,385 in municipal property taxes annually. But if "tax reform" is implemented the new homeowners will be even happier-- their municipal tax bill be decreased 93 percent,to just $1,043.

Now, consider this house, 16 kilometres down the road at West Dover:

Great Starter home in ocean side community, 35 min to Halifax and 5 min from Peggy’s Cove. New flooring, new windows, insulated. Great cottage or year round residence. Private with fruit trees and nice backyard. Won’t last for this price. First time ever on the market.Obviously intended for a less prosperous buyer, it lists for $115,000.

Suppose, as MLS suggests, a young family buys the house as a starter home. Under existing tax policy, the municipal portion of their tax bill will be $781. But if the "tax reform" proposal is implemented, the unlucky starter family will see their tax bill increase 33 percent, to $1,043.

Yes, you read that right: the ocean front mansion and the back-country shack will pay the exact same tax bill.

This particular example is ridiculous in its extreme, but it serves to illustrate the point: whatever arguments "tax reform" advocates have about the relative costs of city services and density, the main effect of "tax reform" will be to aid rich people at the expense of poor people.

Further, environmental justifications for "tax reform" are simply nonsense. Consider that the Glen Margaret mansion, accessible only by car, will pay just $1,043 in taxes, while the average homowner in North Dartmouth, many of whom have no need for a car, will pay $1,316 in taxes.

There's really much, much more to say about "tax reform," and I'll return to again, before council takes up the matter at a regular council meeting, in December.