After months of meetings—what I’ve been calling the regular season of Halifax’s 2024-25 budget talks—we are finally down to the Budget Season playoffs. One city council. Two days—Tuesday April 2 and Wednesday April 3. An awful lot of talk about something called the Budget Adjustment List. It’s going to be great.

The Coast recently polled readers about the city budget, and it turns out quite a few of you don’t really feel like you understand the process, especially the concept of the Budget Adjustment List or BAL. To remedy that, I’m going to go over how it works and turn you into a confident supercitizen with plenty of time to spare before October’s municipal election. Unfortunately for your knowledge, the city is probably changing to a four-year budget cycle next year and we’ll be starting from scratch to know what’s going on. Still, it’s critically important to understand what council’s been doing with your tax dollars up to this point in Halifax history, so here we go with the explainer.

Halifax Regional Municipality’s budget, like any organization’s, is about finding a workable balance between revenue and expenses. Figuring out how much money is coming in, how much is going out, and if anything can or should be done to increase one and decrease the other.

When it comes to expenses, the HRM’s budget is broken down into fixed costs and discretionary costs. Fixed costs are usually the bulk of the city’s expenses. These are things the city knows it has to pay and exactly how much it will cost. City employee salaries, for example, are a fixed cost. There are also fixed costs that are contractually obligated, like the city’s agreement with the RCMP. The HRM is in a contract with the RCMP until 2032, and factors that into the budget.

Discretionary costs are things that change from budget to budget. For example, if the city wants to install a milkshake fountain at the Dartmouth Common for this summer’s Sail GP, that money would be a discretionary expense. If the city wants to turn the milkshake fountain into a permanent thing, it would turn into a fixed cost. (That’s what happened with The Oval; it was a one-off expense to host the 2011 Canada Games speed skating events, but proved so popular that the city kept it.)

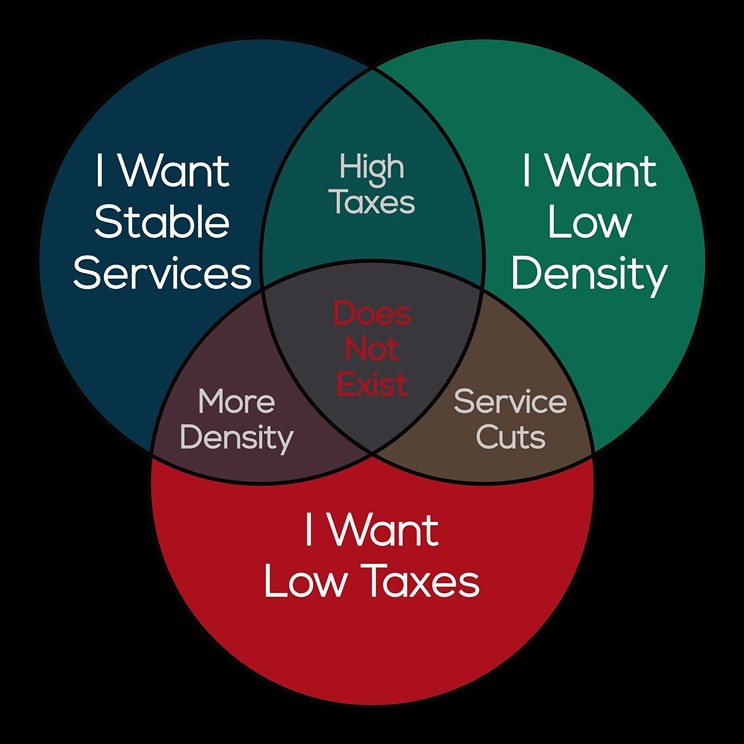

In preparation for Budget Season, Chief Administrative Officer Cathie O’Toole and Jerry Blackwood, Chief Financial Officer and unofficial captain of Budget Season, add up all costs the city has and estimate the cost of things the city wants to do. They also figure out how much money the city is likely to pull in from various sources. It’s important to point out here that the city relies too heavily on property taxes, which make up about 71% of the HRM’s municipal revenue. Other, financially healthier, cities have more diverse revenue streams and generate revenue with user fees. Or they raise taxes. Since our councillors have a record of making bad decisions for the long-term health of the city, they will often choose to not raise user fees on high-cost infrastructure (e.g. parking fees) and will also choose to keep taxes lower than inflation, which means every year the city of Halifax never has enough money to do what it wants.

But city staff try, and in the leadup to every budget season they try to predict how much more money the city will need based on population growth trends, as well as people’s ability to pay their taxes. There’s a lot of legal complexity, but the massively abridged version is that cities are expected to provide most of the government services we rely on without a way to pay for them—except with property tax revenue. With all of that research done, the CFO and CAO (mostly the CFO) also figure out what they have to do with the property tax rate in order to fund everything. This year the projection is for a 9.7% increase. (If the tax rate is 5%, an increase of essentially 10% means the new rate is 5.5%, not 15%.) This increase is required because of things like the suburbs being designed to hemorrhage public money; exacerbating this issue, they are taxed low like rural areas, but well-serviced like urban ones.

The first budget meetings of the 2024/25 fiscal year started late last calendar year with a bit of an exhibition game—a strategy meeting to make sure the city’s bureaucracy and its elected officials agree, broadly speaking, on how the city’s money should be spent. The HRM is a place and a municipality, but it’s a corporation too, and the corporation is divided into “business units,” like Halifax Regional Police and Halifax Transit. Once the CFO and CAO do the math, they tell the city’s various business units what they’re going to recommend to council as a budget, and direct the business units to come up with a plan on how to spend their allocated money. Anything over their allocated money is called a “budget over.”

The business units then come to the municipal government’s Budget Committee—a committee of all city councillors—and explain how they’re proposing to spend the money based on the CFO’s plan. Each business unit can also include what they want to do above the money they’re given, and ask for money for it. If these extras are approved by the Budget Committee, they’re moved to that special holding tank of bureaucratic ambition, the Budget Adjustment List.

These meetings are the bulk of Budget Season—its “regular-season games,” if you will. And as they progress, the BAL grows longer. When all the business units have had their say, and their fixed costs have been accounted for in the budget, council goes into the playoffs to figure out what they can afford from the BAL and what requests have to be denied.

This year this process looked a little different thanks to a motion from councillor Tim Outhit. His motion instructed staff to prioritize municipal strategic plans when putting together this year’s budget. While it seems like this is something that should always be true and not need instruction from council, historically the HRM’s business units have created their budgets like last year’s spending was sacrosanct and new spending—even spending in line with municipal priorities—needed to be jammed into established fixed cost spending. Except for Halifax Transit and the Department of Transportation and Public Works, every municipal budget unit got the memo and prioritized municipal strategic plans as instructed. As a result of Outhit’s motion, most new strategic spending for the city’s well-run departments has already been baked into the fixed spending part of their budget and won’t be up for discussion during the BAL debates, with three notable exceptions:

- The Parks budget is up for some cuts thanks to a motion from coucillor Tony Mancini.

- Halifax Transit is not following its strategic priorities planning documents, so its spending plans are dumb. This may have been corrected by a motion from councillor Waye Mason.

- The Department of Transportation and Public Works just can’t stop suffocating the city. It continues to plan for and sink money into life-ending, city-bankrupting automotive infrastructure. Building out the entire AAA bike network would cost about $50 million, but it’s treated as a discretionary item. This year we’re spending $60 million on street re-paving to pave 54.5 km of the HRM’s 5,000 km of roadways. This sort of thinking is what DPW head Brad Anguish brought to budget discussions this year, despite explicit instructions from Outhit and council not to do so.

Anyways, after the regular season of business unit meetings, all of the things council has identified as thing to add (or remove) from the budget, it’s thrown on a list to adjust the final budget—the Budget Adjustment List—and council has a final meeting (or series of meetings) where it deals finalizes that list. These meetings are the “playoffs.” After the playoffs Blackwood figures out how to pay for everything, he (and his team) puts it all together in a final budget and council votes to ratify it. If it passes this step, currently scheduled for April 23, 2024, the budget is done.

Until next year. Or, if COVID gets real bad again, maybe another budget will be recast in the summer. That’s what happened a few years ago.

The big financial problem the city has this year is that it’s broke. Council’s focus in past years on reducing taxes means the services the city provides, like the library, are now very lean because the city has been steadily cutting them back. And reducing taxes leaves the city with less money to spend. Other levels of government have the option of running a deficit budget—going into debt—to “pay” for expenses. The HRM can’t. If the HRM wants to borrow money, it needs to get permission from the province.

The city legally has to have a balanced budget. It also legally has to do things like repair buildings. So the choice before council—since they don’t seem to want to raise user fees—is one of three things:

Cut services

Since the services we get now are already incredibly lean, further cuts will be extremely noticeable unless services with limited demonstrable value to society are cut, like the police. We likely would not notice a significant cut in police services. In fact, in New York when the police went on strike, crime went down with fewer police on the streets.

Raise taxes

It means taxes don’t skyrocket later, and the city can do more stuff that we need, like build bike lanes.

Do nothing

Don’t cut services, don’t raise taxes. This is the worst of the three options. It means taxes will have to go up more than we might have expected this year, but it won’t happen until later years. Practically speaking, what this means for you is the following: You can complain about potholes not being fixed, or you can complain about taxes going up. But you can’t do both.

Well, you can do both—but it’ll just let everyone know you didn’t read this article, and we’ll judge you.

Like this.

And just one final note about that move to four-year budgeting we talked about at the top. If implemented correctly, it will be a massive benefit to the city. But until then, sit back, stress out and rant at your friends about how the city spends your money.