I was at the meeting, and followed the debate closely, but I have no idea how anyone could have tallied the number of comments made by councillors, much less make an assessment of their factual validity---more likely, the figures were pulled out of someone's ass. But, thinking that Fraser could provide details for his claim and lay out his evidence for all to see and independently evaluate, I called him Monday and asked for proof for his figures.

"That [40 percent figure] was provided by an insider," he explained, but declined to give the name of the "insider."

Tuesday night, though, councillor Tim Outhit told me "the actual figure is 38 percent," and that supposed exacting calculation was made by "senior staff."

Think about this. Our governmental system is designed such that council makes political and policy decisions, and staff implements those decisions. But, evidently, staff has taken it upon themselves to, first, make political judgements about council's decisions, second, compile reports essentially calling councillors liars and, third, share that "insider" information not with the public generally, but only with political groups on one side of the equation.

It's a clear case of staff insubordination. But that insubordination, and Fraser's email, are part of the predictable response to the killing of "tax reform," and echoes sentiments expressed in two unsigned Chronicle-Herald editorials and two Marilla Stephenson columns in the same paper.

Let's deconstruct some of those responses.

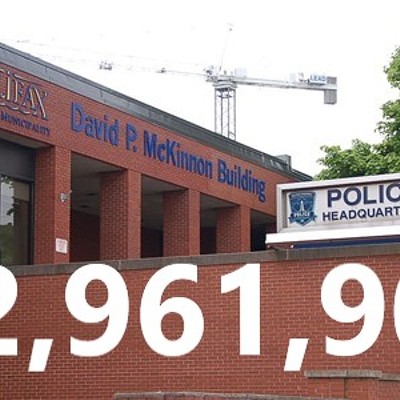

First, understand that the backlash comes from people who stood to land significant financial gains from "tax reform." Taxes on Fraser's $348,600 home, for example, would’ve been reduced by perhaps $1,500 annually. Marilla Stephenson owns, for the moment (more on this presently), a house in Wedgewood that is assessed at just over $400,000; she would have seen her annual property bill reduced by about $2,000 under “tax reform.” I have no idea who the "senior staff" at City Hall is, but taxes on both Chief Administrative Officer Dan English's $299,700 house and "tax reform" guru Bruce Fisher's $286,800 house would've also been cut, oh, a thousand to 1500 bucks annually. A decade or two out, we're talking real money---enough to put a couple of kids through school, or to buy a nice sailboat, maybe even put the down-payment on a second or third house.

I can hear the denials now: "Oh, we wouldn't support something just because our personal taxes would go down." And sure, I doubt that anyone set out to directly conspire to reduce their own taxes. That's not how it works. Rather, when you and your social group find that by happy circumstance you'd save a hell of a lot of money with "tax reform," suddenly the proposal looks very promising, and oh so logical. Were it to go the other way-- were taxes to be increased on the high-end properties you and your buddies own-- there'd be an equal realization that the proposal was preposterous and down-right irresponsible, really.

It's called "class bias," and the reactions to the "tax reform" proposal reveal it in spades. We have a situation now where many of the well-heeled-- the mucky mucks at the Chamber of Commerce, the right-leaning business groups, the "senior staff" at City Hall, the married-to-a-mucky muck-at-the-chamber columnist, etc-- think it's a perfectly swell idea to raise the taxes on tens of thousands of below-median priced homes and cut taxes on above-median priced homes.

Again, I hear the protests: "home value has nothing to do with wealth!" That line was certainly thrown out at the council meeting on January 26, and at other council meetings. Like the "40 percent" falsehood figure, this claim is complete and utter bullshit.

When I've asked people making the "home value has nothing to do with wealth" to back up their claim, they refer back to the Tax Reform Committee report, which reads:

Very little information exists to evaluate the relationship between wealth or income and property values. Few studies appear to have been done in this area. However, every five years, Statistics Canada conducts a census of Canadian residents asking a variety of demographic, social and economic questions. One in five households are asked about their household income and (for homeowners) the value of their home. Staff assisting the Tax Reform Committee have obtained special customized data from Statscan showing this relationship between income and home values.See what they did there, in just two paragraphs? They started with the a statement that included wealth, but ended up speaking of only income.This analysis was first undertaken with data from the 2001 census. A Regression Analysis was run on the data and a Correlation Coefficient and a Coefficient of Determination or r-squared was calculated. A r-squared is expressed as a number between 0% and 100%. Zero shows no correlation while 100% shows a perfect correlation. In the case of the 2001 census data the value of a weighted analysis of table occurrences showed only a 27% r-squared. This shows that the value of one’s home is not a good predictor of one’s income. In other words, there is not a significant relationship between income and home value.

[first emphasis added, second emphasis in original]

It is true that home value and income are not perfectly aligned, but income and wealth are two very different things. In our society, most people's wealth is almost entirely tied up in their houses.

In fact, home-ownership has long been a sensible strategy for wealth collection. People decide to buy houses for many reasons, but young families often choose to spend a more-than-average portion of their income on to buy a house, precisely because doing so is a good route to building future wealth.

Of course income and property values don't align-- it depends on what stage in a home owner's life you're looking at: young home owners will typically spend a relatively high percentage of their income on a home purchase (and the resulting taxes); as they age and presumably get raises and more rewarding careers, those home costs become a smaller percentage of their income; and after their retirement, their income once again drops, and so the housing costs again are a relatively large percentage of their income. (Property value-to-income ratios will roughly track these changes as well.)

We've got lots and lots of home owners at varying stages in their lives, so it's no surprise that we don't see a strong correlation between income and house values.

But because the home is the primary source of wealth, home values are a pretty good reflection of wealth-- not perfect, but far better than any other wealth tax we have in Canada. You can talk about r-squared values til you're blue in the face, and the mumbo jumbo evidently fools a lot of people, but it has nothing to do with the correlation between wealth and home value.

I realize that not everyone fits into the typical home ownership mold. It's unfortunate, but life circumstances--death of an income-earning spouse, loss of a job, medical emergency, etc.-- sometimes cause people to lose their homes.

Marilla Stephenson, for example, is presently trying to keep her house. Due to a poor business decision on the part of her husband and a court judgement, she might soon find the bank repossessing her house. Stephenson has appealed the court ruling, and the court will soon make a ruling; if the court rules against her, she'll have to come up with $100,000 or so to keep her house, an unlikely scenario.

Councillor Gloria McCluskey holds this against Stephenson. "Who is she to tell us how to run our finances when she can't keep her own house in order?" McCluskey asks, rhetorically. But I'm not unsympathetic to Stephenson's position-- life sucks sometimes, and we go through ups and downs.

The government shouldn't be cold-hearted about these life changes, and in fact the government isn't cold-hearted about them. HRM has a worthy property tax deferral program:

The amount of tax deferred is a "lien" against the value of the property. The debt is collected if title to the property is transferred to another owner (such as in an estate settlement, a divorce, tax sale or if the property is re-possessed by a bank). The total amount deferred on a property cannot exceed 75% of the assessed value of the property.In fact, according to Bruce Fisher, no one at all in the deferral program is anywhere near the 75 percent limit. In other words, that much-loved widow who has to sell her house in order to pay her property taxes is a compete fiction: she does not exist. Rather, the proponents of "tax reform" would have us increase taxes on modest homes so that the heirs of a house-wealthy widow will have a larger inheritance.

(I was speaking to my favourite bartender the other night, and he made the related point that the "protecting the widow" line is an argument for "lowering taxes on south end widows, and raising taxes on the retired guy in a trailer in Hubbards." Smart bartender, that guy.)

Regardless, there's enough flexibility built into our property tax collection system that sudden life changes don't result in the loss of a house due solely to property taxes, and it's dishonest to suggest otherwise.

Of course people will make bad decisions and buy beyond their means or, like Stephenson, get caught up in other unfortunate life changes, and those events might result in the loss of their homes. It's sad, truly.

I've gone on for too long, so let me come back to where I started. I've laid out my arguments above, just as I've laid them out before. These arguments are, obviously, written, and anyone can dissect them, disagree, argue contrary-wise, put up competing claims. To the extent that I haven't documented and made clear my arguments, I've failed.

But a great deal of the comments put up by the pro- side aren't arguments at all. Like Fraser's "40 percent factually wrong" comment, there's no substantiation for them, no attempt to document them. How is it even possible to argue against something like that, other than to say it appears to have been pulled out of someone's ass?

Or, the comments are ad hominem attacks, simply dissing, say, TIm Bousquet for writing for The Coast, and never mind his arguments, or faulting Gloria McCluskey, as the Chronicle-Herald did, for being the " De-facto Mayor of Head-in-the-Sand Regional Municipality." (So far as “tax reform” goes, the Chronicle-Herald has turned on its head the old truism that newspapers should comfort the afflicted and afflict the comfortable.)

The councillors who voted to kill "tax reform" did so because they saw that the process would necessarily result in an unjust tax system; there's no "comprising," no amount of "continued work" to somehow change that fact, and so their vote was a proper one, from their perspective.

That vote, though, was simply unacceptable to the elite of Halifax, and the elite is now firing back, throwing up any old bullshit, hoping that some of it sticks.