It’s never been more expensive to live in Nova Scotia, and almost half of the province’s workers aren’t earning a living wage, according to a report released on Wednesday by the Canadian Centre for Policy Alternatives. The living wage, or hourly pay rate needed to cover basic needs and enjoy a “decent quality of life” is now $23.50 in Halifax, up from $22.05 last year.

“Life should not be a constant struggle. Yet, for many Nova Scotians, that is their reality, and the challenge to make ends meet has gotten even tougher this year,” writes Christine Saulnier, director of CCPA’s Nova Scotia branch, in the report.“We have not seen this level of increase since we started calculating the living wage in 2016.”

The report cites rising costs for shelter, food and gas in particular as the cause for the rising living wage. In addition, it’s gone up “because there were no permanent, substantive increases to government income benefits to offset the rising costs.” Between June 2021 and June 2022, the report says rental costs in the province increased by 8.2%, food by 8.8%, and gas by a whopping 60.5%.

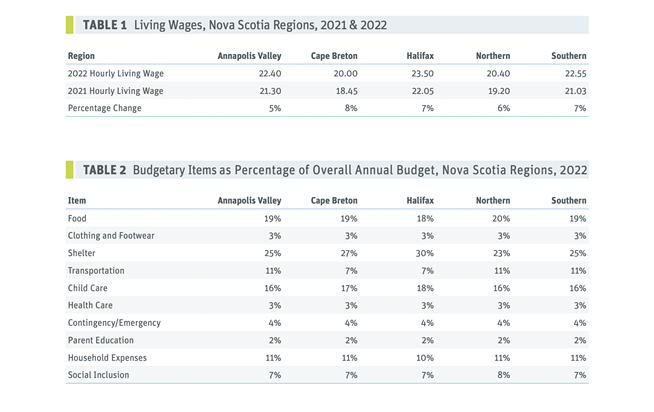

Regions across Nova Scotia saw living wage increases between 5% and 8%. The rates are $22.40 in Annapolis Valley, $20.00 in Cape Breton, $20.40 in “Northern” NS and $22.55 in “Southern” NS.

Meanwhile, the median hourly wage in Nova Scotia (as of June 2022) is $22.40. The province has the second-lowest average weekly earnings in the country, following PEI. Average weekly earnings rose 4.1% from 2021 to 2022, the report notes, not keeping up with inflation, which hit 9.3% in June—the highest jump since 1982.

The CCPA calculates the living wage rate based on a family with two parents and two children. For Halifax, the $23.50 per hour living wage works out to a gross (pre-tax) household income of $85,540.

That figure comes from the living expenses of a “reference family” outlined by the Canadian Living Wage Framework: a heterosexual couple between the ages of 31 and 50 with two children, a seven-year-old boy and a four-year-old girl. The parents both earn the same wage and work 35 hours a week. They rent a three-bedroom dwelling and one parent is taking part-time courses at NSCC.

While that sounds like an income needed for a specific demographic to support a specific lifestyle, Saulnier says it’s intended to be a universal living wage rate. “We chose the reference family as the peg, as the high-water mark for the living wage rate,” she says in an interview with The Coast. “It was to make sure that we at least have a threshold that can cover as many different family types as possible—there's no way to publish a wage rate that can cover every single family type.

“It's a methodological question, but it's also a discrimination question. Even the fact that we show different economic regions could lead to discrimination. We will never publish an individual wage, we will never publish a single (parent) with two kids wage, because we do not want to see employers thinking they need to tailor wages,” she says.

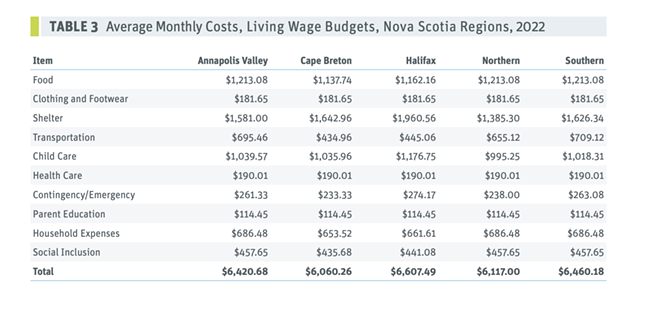

The living wage budget is a “conservative estimate” that includes 10 expense categories: food, clothing and footwear, shelter, transportation, child care, health care, contingency/emergency, parent education, household expenses and social inclusion. The social inclusion category includes expenses such as sports and music classes, holiday gifts, movie tickets, restaurant meals and children’s toys. In Halifax, the budget comes up to $6,607.49 a month.

To improve the quality of life for working Nova Scotians, both “private and public sector employers should strive to pay all their employees, direct and contract, a living wage,” the report reads. “Governments should not be contributing to the problem by paying poverty wages. Government budgets are impacted by the high costs of poverty, whether by productivity loss or by the pressures on its budget to help people manage to live on a low income. Municipalities should be living wage employers, as should hospitals and other public bodies, and all public procurement should include provision for paying contract workers a living wage,” Saulnier writes.

Nova Scotia’s minimum wage is $13.35 per hour currently, with planned increases set to take it to $13.60 on October 1 and $15 by April 2024, which Saulnier writes is “too slow.” According to the report, approximately 106,000 workers in Nova Scotia earn less than $15 per hour, and another 102,000 earn between $15 and $20. “Businesses need to figure out what it takes to pay a wage that's not exploiting their employees,” Saulnier says.

“These workers will spend virtually every dollar they make and stimulate the economy,'' Saulnier writes as a reason to raise the minimum wage—beyond $15. “Strong minimum wage policies reduce the need to use the tax system for redistribution and help stimulate overall purchasing power and aggregate demand.”

Saulnier says while a minimum wage increase is crucial, “it’s not just on the employer’s shoulders—government can do other things itself.” The report points out “the importance of assuring that our tax system is progressive and that government income transfers are generous,” calling for higher taxes on the wealthy and higher income thresholds for benefits such as the Canada Child Benefit, Nova Scotia Child Benefit and the NS Affordable Living Tax credit.

“Nova Scotia really has some of the least generous income tax credits and support,” Saulnier says. “If you were to earn a living wage in Nova Scotia, you don't get access to any of the income supports that exist in this province.”

In addition, the report suggests non-market-based solutions to the high cost of living, including cheaper public transportation, more affordable housing and permanent rent control, universal pharmacare and free post-secondary education. “There are things that we can be doing to be lessening the amount that people are paying out of pocket: prescription drugs, dental care, eyeglasses, and people are paying for a lot out of pocket that government has control over,” Saulnier says.

“If employees are earning enough, then they are less stressed. They're eating, they're doing all the things that they need to do to take care of themselves and come to work and do the work that their employers want them to do. So you know, you can't treat people like they’re cogs and think that’s going to be the best that you get out of people.”