As vacant lots go, the Texpark site at the corner of Granville and Sackville Streets is the epitome of Halifax's "missing teeth"—an otherwise prime development lot that sits empty, without buildings or even landscaping. A dented and rusting chain-link fence surrounds the gravel lot, which is rented out for parking, but it's not hard to imagine an office tower or condo complex rising above Granville, providing spectacular views of the harbour. As it is, however, Texpark is a blight on downtown, an embarrassment.

Readers will best know Texpark as the site of two failed development proposals: Twisted Sisters and Skye Halifax, both put forward by United Gulf Developments.

But here's something that isn't so well known: The city can reclaim the Texpark site, taking it away from United Gulf and allowing some other developer to build there. In order to claim the site, all the city has to do is invoke a "buy-back" clause that was included in the 2004 sale of the property to United Gulf. That would cost the city $5.36 million upfront, but an analysis of the potential value of the site shows that the city could re-sell it for at least $10 million, and probably much more.

Moreover, if the city invoked the buy-back clause, it could very quickly get Texpark developed, filling in the embarrassing missing tooth.

Last week, as The Coast was making inquiries about the buy-back provision, politicians, developers and city officials began discussing the issue in earnest. As a result, potentially as soon as next week, regional council will discuss a potential buy-back.

How United Gulf got the property

"Texpark" was the name of a city-owned parking garage with a service station on the ground floor. It was built in the early 1960s, and leased out. By the early 2000s, the garage was in deplorable condition, and the city had built a replacement parking garage next door, the Metro Park garage.In 2004, city council decided to put the Texpark site out to tender, to prospective developers. Five developers bid on the site, and council selected the winning bid at an in camera session of its May 25, 2004 meeting. The staff report to council was secret, but last week The Coast asked to receive the report, and it was declassified and released to us. See the complete report here. The report outlines the five proposals for Texpark, as follows:

Giffels ManagementThe highest bidder was Templeton Lawen, which offered $5.8 million for the property, but city staff recommended that the next highest bidder, United Gulf, be awarded the tender, even though that meant the city would receive just $5.36 million, nearly half a million dollars less than Templeton Lawen was offering.

Pay to city: $3.5 million

Building: one 17-storey tower

Use: retail and office on first two floors, 224 residential units above

Cost of development: $33 millionSouthwest Properties

Pay to city: $4.025 million

Building: one 22-storey tower

Conceptional use: retail and office on first three floors floors, 150 hotel rooms on the next 10 floors, with residential on the top nine floors

Cost of development: $46 millionUnited Gulf

Pay to city: $5.36 million

Building: one 26-storey tower

Conceptional use: Commercial at ground floor, with a hotel and unspecified number of residential units above

Cost of development: $59 millionTempleton Lawen

Pay to city: $5.8 million

Building: two towers, 24- and 28-storeys, atop a base.

Conceptional use: Commercial at ground floor. One tower would be a hotel, with 240 rooms. The second tower would hold 176 residential units.

Cost of development: $60 millionUniversal Property Management

Pay to city: $3.7 million

Building: one 21-storey tower

Conceptional use: Commercial on first two floors, with the remaining consisting of 108 hotel rooms and 95 residential units.

Cost of development: $33.2 million

Staff had several objections to Templeton Lawen's bid, but the biggest concern seemed to be that TL wanted guaranteed approval for development. As the staff report explains:

Through these conditions the proponent is seeking a “guaranteed project” on their terms and has placed the majority of the project risk on the Municipality. The property has been offered for sale as is vacant without purchaser conditions, except standard due diligence. The terms requested by Templeton Lawen are a significant departure from the tender specification and represent an unacceptable and undefined environmental and financial risk for the Municipality. [emphasis in original]The staff report is clear: The city would not guarantee that the development proposals submitted by prospective developers would automatically be approved. The winning developer had to go through the normal public hearing process and development approvals that any developer would have to go through, and if the developer couldn't get approval, well, tough luck.

There was, however, an interesting twist to the process. If for any reason, the winning developer could not get construction started within four years, the city could buy back the property for the purchase price. Then, should council decide to, the city could re-tender the property, opening up the entire process all over again.

It's hard to nail down exactly what the buy-back clause says. The initial tender offer, which was a public document and would spell it out in detail, has been destroyed, says city spokesperson Michaelyn Thompson, explaining that it is common practice to destroy such documents after seven years.

But the staff report awarding the tender makes mention of the buy-back clause in several places, most particularly in a section detailing "acceptable amendments," where two of the bidders wanted the buy-back to be a second lien on the property, so as not to affect bank financing. Still, that staff report doesn't spell out the language of the clause.

Neither does a 2007 development agreement for the site contain the buy-back clause.

Thompson acknowledges that the buy-back clause exists, but says it "is included in the purchase and sale agreement which remains confidential and can’t be released."

Still, the buy-back clause has been an open secret for nine years. Then-councillor Dawn Sloane mentioned it at a public hearing in 2006. Last week, former councillor Sue Uteck confirmed that the buy-back clause exists, and said the city could invoke it after four years from the sale.

"I’ve seen the contract and can confirm that it includes a buy-back clause," says councillor Waye Mason. "But I can't release it. The city says it can't release the contract, but I'm not sure they're right about that."

Mason says that for the time being he is obligated to respect city lawyers' view that the sales contract is not a public document, but he has asked for a report to council on the issue, detailing the legality around the secrecy and whether the city should invoke the buy-back clause.

How soon might we see that report?

"Well, I told them [The Coast] was asking questions about it, so I think we'll probably get it next week."

Twisted Sisters and Skye Halifax

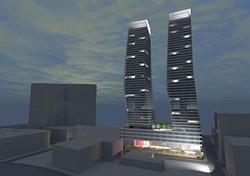

When United Gulf bid on the tender in 2004, the company said it wanted to build one 26-storey residential complex with retail on the ground floor. This was a distinctly different proposal than was submitted by Templeton Lawen, which had wanted to build two towers on the site, at 24 and 28 storeys, one of which would be a hotel, the other residential.But a funny thing happened after council awarded the tender to United Gulf: The company went and put together a development proposal that looked nothing at all like the single building it had outlined in the tender, but looked a lot like the two buildings Templeton Lawen had proposed.

When United Gulf brought a development application forward in 2005, it contained two 27-storey towers, one a hotel, the second condos. The project was dubbed "Twisted Sisters" after the twirl in the two towers.

After the required public hearings, council unanimously approved Twisted Sisters on February 7, 2006. But heritage groups had opposed Twisted Sisters, saying it reached into the protected viewplanes from Citadel Hill, and appealed council's decision to the Utility and Review Board. In September of 2007, the UARB ruled that the project could move forward.

By that time, however, the American housing bubble had burst, and the world's financial institutions were in crisis. Financing for new developments, particularly for residential developments, had dried up. Twisted Sisters was never built. Council's approval for the project expired in 2008.

Theoretically, the city could have invoked the buy-back clause in 2008, but it made no sense to do so at that time, says Mason. "The reason [the clause wasn't invoked] isn't because the city is lazy or not following up, but rather because the economy went into the crapper in 2008."

With no financing available, no other developer would be able to build on the site either, so if the city bought Texpark back, it'd simply have an empty lot.

But financing has eased considerably since 2008, and now the global financial industry is working more or less as it did pre-crisis. There's money to lend for new developments again. Moreover, HRM By Design, the planning strategy for downtown that fast-tracks development approvals for projects that fall beneath certain height limits, has been implemented. As a result, we're seeing lots of new construction downtown.

HRM By Design puts a height limit of about 24 storeys on the Texpark site. Any proposed development under that limit merely has to meet basic design guidelines to get approved without a public hearing. Any proposed development over the height guideline, however, must go through a much more complicated and lengthy Development Agreement process, which entails multiple reviews by city staff and a public hearing before final approval by council.

Last year, United Gulf put forward a new proposal for Texpark, called Skye Halifax. Consisting of two 48-storey towers containing apartments, it was by far the largest and tallest development ever proposed in Halifax, and more than doubled HRM By Design's height guidelines for the site.

It's impossible to know if Skye was a serious proposal or not. Some speculate that United Gulf simply wanted to break the HRM By Design height guidelines so that other properties downtown would get similar approval even though they too violated the height guidelines, or that the company was looking to get approval and then flip the project to another developer.

Regardless, every planner and regulator who looked at the Skye Halifax proposal said it was too big for the services available downtown and would overwhelm the downtown market for other developments, much the way Purdys Wharf did in the 1980s.

In November, the newly elected city council voted to kill Skye Halifax, refusing to allow the proposal to continue to the public hearing state. Notably, new mayor Mike Savage issued a blistering attack on the project.

With Skye rejected, we're left with an empty Texpark lot, downtown's biggest "missing tooth." Clearly, United Gulf has run out of steam, and observers don't expect the company to put forward a new proposal for Texpark any time soon. But, there's that buy-back clause that council could invoke at any time.

Should the city buy back Texpark?

With construction cranes now dotting the downtown landscape, but with United Gulf unable to move a development forward at Texpark, it's time for the city to consider invoking the buy-back clause and re-tendering the property, with the idea of finding another developer who could make a go of it.But would anyone buy it?

We asked a commercial real estate appraiser what he thought Texpark was worth. The appraiser doesn't want his name used, because he has not looked at the situation in detail, but he gave us some back-of-the-envelope calculations to run.

"For that site, I would say the land is worth $30,000 per unit," writes the appraiser in an email. "Get the development agreement for Twisted Sisters (the one that was approved and not built). Each unit should be 1,150 square feet of gross floor space (1,000 net of hallways). That is a typical two-bedroom unit. If the plans list the gross floor area of each floor plate, divide by 1,150 SF and multiply times $30,000 and you will get your answer. My gut reaction is that it's worth it."

The staff report for Twisted Sisters says each floor plate was 12,800 feet, or 11 units per floor by the appraiser's reasoning. But it's unclear if that 12,800 feet is for one or two towers. The diagrams in the proposal, however, show two towers—the larger residential tower has 10 condo units on each floor, while the smaller second tower had 12 smaller hotel rooms on each floor.

Using Twisted Sisters as a loose guide, we think conservatively that a developer could fit eight two-bedroom units on each floor of each tower. If that developer built to the HRM By Design height limit of 24 storeys for the site, the developer could construct 384 units. At $30,000 each, that's $11.52 million.

"Your calculations seem right on," says the appraiser. "I would just round your numbers off to $10 to $11 million."

So there we have it: the city could invoke the buy-back clause and obtain the Texpark site for $5.36 million, then turn around and re-sell it for $10 to $11 million to a developer who wants to build something that meets HRM By Design's fast-track approval guidelines.

Mason says the issue should at least be explored, and so has asked for the staff report.

And while the appraiser thinks the buy-back makes immense sense, he's skeptical the city will pursue it. "They have no balls and will never do that," he writes. "But it's interesting."