CBC anchor Tom Murphy peered sternly into the camera during the six o’clock TV news on Tuesday to deliver the day’s top story: “Confirmation tonight of what many Nova Scotians have long suspected,” Murphy said with a knowing shake of his head. “We pay more in taxes than anywhere else in the country.”

“And that’s not the opinion of some anti-tax group. It comes right from the government in a report from the finance department," chimed in co-anchor Amy Smith.

She then introduced reporter Paul Withers who told viewers the government report on taxes had been “hiding in plain sight since April when it was put on a Nova Scotia Finance Department website with zero fanfare.” As Withers talked about the 129-page report, the words “Highest Taxes in Canada” appeared on the screen. To hammer the point home, he declared: “The Canadian Taxpayers Federation is talking about another big finding in this report, namely that Nova Scotians pay the highest level of taxation anywhere in Canada.”

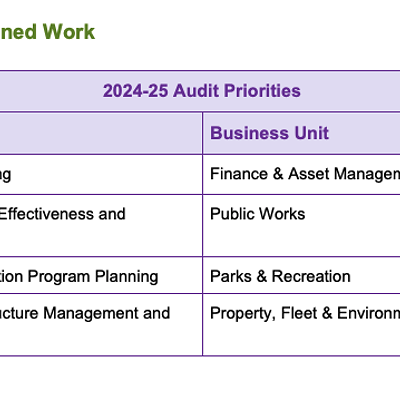

A multi-coloured bar graph filled the screen as Withers added, “The report shows when federal, provincial and local taxes are added up, Nova Scotians pay the highest share of GDP in Canada, just ahead of PEI.” He apparently meant that Nova Scotians pay the highest taxes as a proportion of provincial Gross Domestic Product, a standard measure of the total size of an economy. Withers then brought on Kevin Lacey, Atlantic Canada director of the Canadian Taxpayers Federation.

“Finally, the government itself is informing taxpayers,” Lacey said, “that they are being taxed higher than anywhere else in Canada. And I think it leads to calls for beginning to reduce these taxes so that we can make this province more competitive.”

Murphy, Smith, Withers and Lacey (a former aide to Stephen Harper) all seemed dead sure of their claims, but a close look at the provincial tax report shows all four were spouting a half-truth plucked out of context. They were also ignoring other parts of a massive, highly technical report.

What the tax report really says

“On average, Federal taxes paid by Nova Scotia residents are equal to the national average,” the report says on page 84, adding that “however provincial taxes as a share of nominal gross domestic product exceed the national average marginally.”

Yet the report also says: “Within Canada, Nova Scotia’s average total effective tax rate is third highest among the provinces.” That point was echoed by provincial finance minister Graham Steele, who told reporter Brian Flinn of allnovascotia.com on Wednesday that Quebeckers pay much higher taxes than Nova Scotians. He said that measuring taxes as a proportion of the provincial economy makes them look higher because Nova Scotia’s GDP is relatively small. In an apparent reference to another graph on page 88 of the report, Steele said when taxes are measured on a per person basis, Nova Scotia is actually way down the list.

James Sawler, who teaches economics at Mount Saint Vincent University, agrees that on a per capita basis, Nova Scotia does not have the highest taxes. He also points out in an email forwarded to The Coast that “the need for adequate health, education and social programs does not depend on GDP. Given that our GDP is smaller, if NS is to provide programs comparable to other provinces, we may need to tax a greater percentage of GDP.”

NS income tax rates lower for most

The conflicting claims over the technicalities of measuring tax levels have obscured other significant aspects of the provincial report. For one thing, it points out: “Individuals earning less than $30,000 per year comprise the majority of the population in Nova Scotia.” Yet, a chart on page 97 shows that people in that income bracket pay a lower rate of provincial income tax than in most other provinces. (Nova Scotia’s 8.79% rate is fourth lowest.)

The report also states that “it is clear that Nova Scotia’s income tax has a significantly more progressive rate structure than other provinces.” That means that Nova Scotia income taxes are more geared to ability to pay as people in higher income brackets are taxed at higher rates.

“We want to see those who can afford to pay, pay their fair share,” says Christine Saulnier of the left-leaning Canadian Centre for Policy Alternatives. “Nova Scotia is one of the leaders in the country in terms of progressive taxation and that should be something that we are actually proud of in this province.”